Offshore Trusts for Business Owners: A Hidden Asset Protection Tool

Offshore Trusts for Business Owners: A Hidden Asset Protection Tool

Blog Article

Why You Should Consider an Offshore Trust for Shielding Your Properties and Future Generations

If you're looking to protect your riches and guarantee it lasts for future generations, considering an overseas depend on might be a clever step. These counts on provide unique advantages, such as improved asset protection and tax obligation effectiveness, while also keeping your privacy. As you explore the possibility of offshore trust funds, you'll find exactly how they can be customized to fit your particular demands and goals. Yet just what makes them so appealing?

Understanding Offshore Trust Funds: What They Are and Exactly How They Function

When you think regarding securing your possessions, offshore depends on could come to mind as a viable option. An overseas count on is a legal arrangement where you move your properties to a trustee situated in one more country.

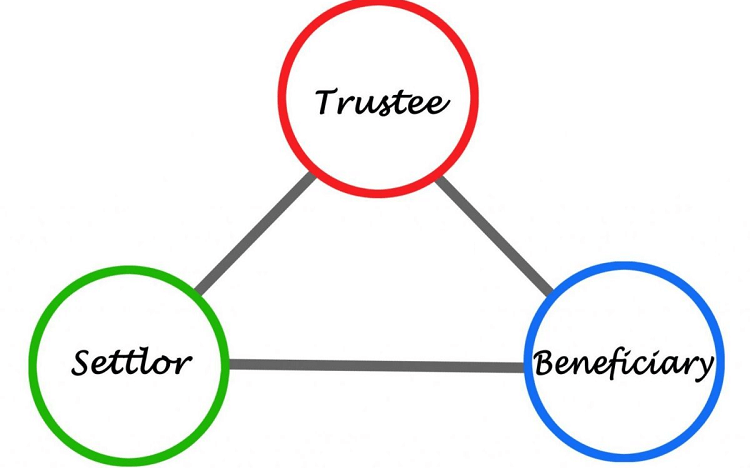

The key parts of an overseas depend on include the settlor (you), the trustee, and the beneficiaries. You can tailor the depend your demands, defining just how and when the possessions are distributed. Because these counts on frequently run under favorable laws in their jurisdictions, they can give enhanced personal privacy and security for your riches. Recognizing how overseas trust funds function is important prior to you decide whether they're the ideal option for your asset defense method.

Benefits of Developing an Offshore Depend On

Why should you think about developing an offshore trust fund? One of the key benefits is tax obligation efficiency. By positioning your possessions in a jurisdiction with beneficial tax obligation legislations, you can possibly reduce your tax obligation concern while ensuring your wide range expands. Furthermore, offshore trusts offer flexibility regarding asset administration. You can customize the depend fulfill your specific needs, whether that's preserving control over your properties or ensuring they're distributed according to your desires.

Offshore trust funds can supply a higher level of discretion, securing your financial affairs from public examination. Developing an overseas trust can promote generational wealth conservation. Ultimately, an offshore count on can serve as a tactical tool for securing your financial legacy.

Safeguarding Your Assets From Lawful Cases and Financial Institutions

Establishing an offshore trust not only uses tax obligation benefits and personal privacy but likewise offers as an effective shield versus legal cases and lenders. When you place your properties in an offshore trust fund, they're no much longer considered component of your personal estate, making it a lot harder for lenders to access them. This separation can shield your riches from lawsuits and cases developing from service disagreements or individual obligations.

With the ideal territory, your possessions can take advantage of stringent privacy regulations that deter lenders from pursuing your riches. Furthermore, lots of overseas trusts are designed to be challenging to penetrate, typically needing court activity in the depend on's jurisdiction, which can act as a deterrent.

Tax Obligation Performance: Lessening Tax Obligation Liabilities With Offshore Trusts

Furthermore, given that trusts are often exhausted in different ways than people, you can take advantage of reduced tax obligation prices. It's crucial, nevertheless, to structure your trust fund correctly to ensure compliance with both residential and international tax laws. Dealing with a certified tax expert can aid you navigate these intricacies.

Ensuring Privacy and Discretion for Your Riches

When it comes to safeguarding your riches, assuring personal privacy and privacy is vital in today's increasingly transparent monetary landscape. An offshore depend on can give a layer of security that's hard to achieve with residential alternatives. By placing your possessions in an overseas jurisdiction, you shield your economic details from public examination and minimize the risk of unwanted interest.

These depends on commonly come with stringent personal privacy regulations that stop unauthorized accessibility to your financial information. This indicates you can additional resources secure your wealth while preserving your assurance. You'll additionally limit the possibility of lawful conflicts, as the details of your trust continue to be personal.

Moreover, having an offshore trust fund indicates your properties are less at risk to individual obligation insurance claims or unanticipated monetary situations. It's a positive step you can take to assure your monetary heritage remains undamaged and exclusive for future generations. Trust fund in an overseas structure to guard your wide range properly.

Control Over Property Circulation and Management

Control over property circulation and administration is among the key advantages of establishing an offshore trust fund. By establishing this trust fund, you can dictate exactly how and when your assets are distributed to recipients. You're not just turning over your wealth; you're setting terms that reflect your vision for your tradition.

You can develop details problems for distributions, assuring that beneficiaries meet certain standards prior to obtaining their share. This control helps avoid mismanagement and assurances your properties are utilized in ways you regard suitable.

Additionally, designating a trustee allows you to hand over management responsibilities while retaining oversight. You can choose someone who aligns with your values and comprehends your goals, assuring your assets are managed wisely.

With an overseas depend on, you're not only securing your wide range but also shaping the future of your beneficiaries, giving them with the assistance they need while preserving your wanted degree of control.

Picking the Right Territory for Your Offshore Depend On

Look for countries with strong legal structures that sustain trust laws, making sure that your assets continue to be secure from prospective future claims. Additionally, access to local banks and experienced trustees can make a large distinction in managing your trust effectively.

It's important to evaluate the expenses included as well; some territories may have greater configuration or upkeep fees. Inevitably, choosing the best jurisdiction indicates straightening your economic goals and family needs with the specific benefits offered by that location - Offshore Trusts. Take your time to research study and seek advice from with professionals to make the most enlightened decision

Often Asked Concerns

What Are the Prices Related To Establishing up an Offshore Depend On?

Setting up an offshore trust fund involves numerous expenses, including lawful costs, configuration charges, and continuous upkeep expenses. You'll wish to allocate these variables to ensure your depend on runs successfully and effectively.

Exactly How Can I Discover a Respectable Offshore Depend On Supplier?

To locate a trusted overseas trust supplier, research online reviews, request recommendations, and validate credentials. Ensure they're seasoned and transparent concerning costs, solutions, and regulations. Count on your reactions during the option process.

Can I Manage My Offshore Count On Remotely?

Yes, you can handle your offshore trust from another location. Several service providers provide on-line access, enabling visite site you to monitor investments, communicate with trustees, and gain access to records from anywhere. Simply assure you have safe net accessibility to secure your information.

What Occurs if I Transfer To a Various Country?

If you relocate to Homepage a various nation, your offshore trust's policies may transform. You'll need to speak with your trustee and potentially readjust your trust's terms to abide by local regulations and tax obligation ramifications.

Are Offshore Trusts Legal for People of All Nations?

Yes, overseas counts on are legal for residents of numerous countries, but guidelines differ. It's necessary to investigate your country's legislations and get in touch with a lawful expert to ensure conformity and comprehend prospective tax effects prior to continuing.

Report this page